Savings Summit Demands Urgent Reform to Improve Future Workplaces

24 November 2022

Written by: vsimons

A Workplace Savings Summit gave voice to experts in financial wellbeing, employers, and students as new research highlights that 48% of employees feel “terrified” about their financial future.

A Workplace Savings Summit gave voice to experts in financial wellbeing, employers, and students as new research highlights that 48% of employees feel “terrified” about their financial future.

The summit was jointly hosted by Cushon, a fintech workplace savings business, and the University of Lincoln, UK, to promote ideas for greater, more effective savings systems that respond to the current cost of living crisis and deliver long-term support structures.

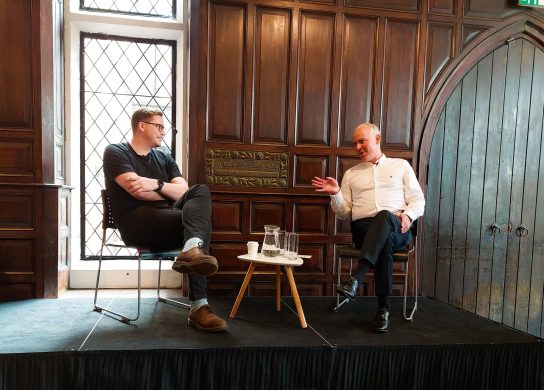

Speakers at the event included Dr Alex George, UK Youth Mental Health Ambassador interviewed by Steven Watson, Director of Policy and Research at Cushon; Sarah Poretta, Money and Pensions Service; Jo Phillips from Nest Insight; Duncan Brown from the Institute for Employment Studies and two current Lincoln students, Emily Kirkham and Eren Baykut.

Emily Kirkham said: “It was an amazing opportunity to be given a chance to have our voices heard on a topic that is going to have a direct impact on us. I know that for me personally as a student, being able to understand what to do with my money and how finances work has been important, and I think that needs to be spread nationwide.”

Neal Juster, Vice Chancellor at the University of Lincoln provided the introduction to the event and said: “At Lincoln, we’re proud to be leading on initiatives that actively help our students to save money, setting an example for employers across the country who want to cultivate enduring financial wellbeing within their workplace.

“The Workplace Savings Summit exemplifies our commitment to shaping a more positive financial future by connecting industry experts, academics, and crucially, students.”

Dr Alex George spoke about how mental ill health has cost the country £90billion in the past year with money currently being the biggest cause of stress. Lincoln’s student speakers confirmed that financial worries affected student wellbeing in many ways including damaging their sleep quality and 34% agreed that their grades have suffered. Money and Pensions Service research similarly found that 4.2 million workdays are lost every year due to a lack of financial wellbeing.

Evidence suggests that businesses should invest into the financial wellbeing of employees through relevant saving schemes and that the government should aid the frictionless introduction of such schemes.

The University of Lincoln’s bespoke saving scheme, facilitated by Cushon, has been nationally recognised as “transformational” at the Employee Benefits Awards 2022 where the University won ‘Best Pension Strategy Award’ and the ‘Grand Prix’ for most outstanding entry from all winners.

The Lincoln scheme allows those who do not qualify for an auto-enrolment pension to build savings through direct deductions from their pay and contributions from the employer. As a result, students holding campus jobs can begin building accessible savings pots in an ISA of their choosing, assisting with savings goals such as property ownership. This trial features as a case study in Cushon’s whitepaper titled ‘Building the financial resilience of the UK workforce: The case for automatic enrolment into workplace savings schemes’.

Cushon’s whitepaper lobbies for a change to government legislation by making it easier for employers to introduce auto-enrolment savings vehicles. Currently, new contracts would have to be drawn up and signed by the employer and employee for the scheme to be legal, introducing delays that Cushon deem to be needless.

The event speakers concurred that this style of saving is far more relevant to students compared to traditional pensions, with Dr Alex George commenting that engagement in traditional pension schemes “seems pointless in many ways” for young people.

Eren Baykut, reflecting on the event, said: “Understanding what the future could look like for the young voice was a phenomenal insight. Seeing so much support and concern for our future gave back a vision of hope. It was an amazing opportunity to have represented so many students struggling and not being heard. I can now look ahead without the burdening concern I used to carry about money.”